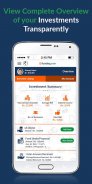

i2iFunding - Investor's App

Description of i2iFunding - Investor's App

Download i2iFunding Investor’s App

to register as a P2P Lending investor and get an opportunity to earn high returns by lending money to verified borrowers.

P2P Lending - An Opportunity to Earn High Returns

✔️ Earn up to 18% Returns on Investment

✔️ Diversify risk by lending money to multiple borrowers

✔️ Generate Steady Income Through EMI

About i2iFunding:

i2iFunding is a Fintech start-up, which was founded in Oct-2015. We are one of the pioneers of P2P Lending in India. Since our inception, we have grown at a very fast pace and have become one of the safest, most trusted and most innovative Peer to Peer (P2P) lending platforms in India. We are an RBI-registered NBFC-P2P Lending Platform. Certificate of Registration No. :

N-12.00468

App Features:

✔️ An investor can complete the simple application form and become a registered Investor on our platform.

✔️ Registered investors would be able to view profiles of active borrowers who have been verified and approved by i2iFunding.

✔️ Registered investors would be able to invest in the profile of active borrowers and see the overview of their investments.

✔️Registered Investors can opt for Auto Invest to deploy funds easily. They will also get an auto-notification once a new borrower is made live.

Sign Up Process:

Fill up personal details, PAN and Aadhar number, mobile number and email address.

> Pay registration fees of Rs. 500+18% GST = Rs 590.0 (Non Refundable)

> Provide address and employment details

> Upload a copy of PAN and address proof

> Provide Bank details which will be used for transactions

Investment Amount Limits:

After registration, investors would be able to invest up to Rs. 50,000 without paying any additional fees.

The maximum investment amount for a single borrower is Rs. 50,000.

The overall investment limit is Rs. 50 Lakhs across all P2P lending platforms.

Investment Process:

1) Create Investor's Account - To begin lending, investors should first create an ‘Investor Account’ by filling registration form either on the web or mobile app.

2) Transfer funds to escrow account - Investors need to transfer funds to the Escrow account (Non-interest bearing) to start the investment. Investors will have to add our escrow account as a beneficiary in their net banking. Investors can transfer funds through any of the following modes from an Indian bank – NEFT, RTGS or IMPS. An investor can also transfer funds using the Paytm payment gateway. (Gateway charges applicable)

3) Set Auto Investment - Investors can Set Auto Investment rules matching their investment preferences to ensure quick deployment of funds.

4) Investors can also invest manually in each profile which is made live on the portal if not funded through Auto Investment. They can review profiles of "Active Borrowers" by browsing the 'Active Borrowers List'. Approved Loan amount, interest rate and tenure are mentioned along with the detailed profile of each borrower.

5. Investing Money - Investors can select borrowers as per their risk appetite and investment preference and then make a commitment to lend money to those borrowers by clicking on the "Invest Now" button and entering "Investment Amount".

Repayments and Monthly Cash Flow –

Every month EMI/Due amount is auto-deducted from Borrower's Bank Account to the Repayment Escrow Account of i2ifunding through the NACH mandate. The total repayment amount collected from borrowers in the Repayment Escrow Account is transferred to the respective investors’ escrow/bank accounts.